THE COIN STREET JOURNAL

Market News - June 9th, 2023

Bitcoin Now Undervalued vs S&P 500, According to This Metric

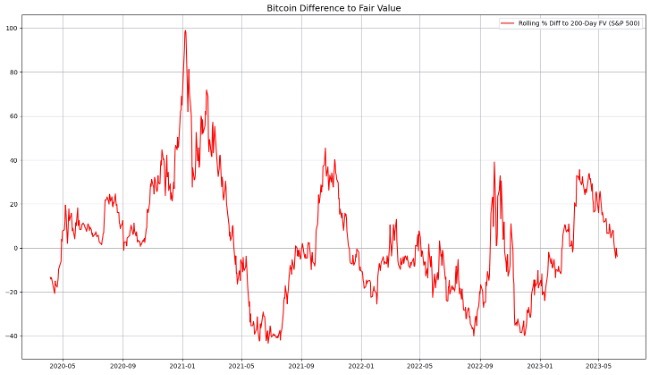

That’s according to a metric that runs an Ordinary Least Squares (OLS) regression of the relationship between bitcoin and S&P 500 over the last 200 days to estimate of fair value for the Bitcoin price based on the current S&P 500 price.

This methodology (an OLS regression of the Bitcoin and S&P 500 prices over the last 200 days) comes up with a fair value of 27,550 for BTC.

At its current price almost exactly $1,000 lower in the mid-$26,000s, bitcoin is currently undervalued versus this estimate of fair value by around 3.7%.

That’s the biggest undervaluation bitcoin has seen versus its 200-day OLS regression-derived fair value to the S&P 500 since mid-February.

Bitcoin and US stocks, particularly growth stocks, have historically had a close trading correlation, with analysts viewing both as speculative risk assets that are sensitive to shifts in interest rates.

US equity markets have been led higher in recent weeks by a surge in big tech stocks amid swelling optimism about the possibility that fast-evolving artificial intelligence (AI) technology will deliver a substantial boost to productivity and profits.

Thanks to the historic correlation between bitcoin and stocks, the more the latter rallies while the former stagnates, the more scope there is for a “catch-up” rally in bitcoin.

Bitcoin was last changing hands close to 15% lower versus yearly highs hit in the $31,000s in April, while the S&P 500 was on Thursday probing yearly highs just under 4,300.

Weakening Correlation Limits Prospect of Bitcoin Catch-up Rally

However, the argument for a bitcoin catch-up rally to the surging equity market isn’t quite as strong as it was a few months ago.

That’s because, while the correlation between the S&P 500 and bitcoin price is still positive, it has weakened substantially over the last 12 months.

This time last year, the 60-day Pearson correlation between Bitcoin and the S&P 500 was above 0.6, as per data presented by CoinMetrics.io.

Meanwhile, as of the 6th of June, it was only around 0.14.

Much of the weakening in the two asset classes’ correlation happened in March, when a mini-bank crisis rocked sentiment in the equity sector, but injected a dose of safe-haven demand into bitcoin.

March’s price action was a sign that investors were finally starting to view bitcoin how its long-time proponents have always wanted it to be viewed – as a decentralized and secure alternative to the current fiat-based monetary system.

Indeed, while bitcoin’s correlation to the S&P 500 has been weakening as of late as investors treat the asset more like a hard-money safe-haven like gold, bitcoin’s correlation to gold has been on the rise.

Bitcoin’s 60-day Pearson correlation to Paxful’s tokenized version of gold (PAXG), which tracks the spot gold price closely, was last around 0.22, having recent hit highs for the year above 0.3.

ROBINHOOD REMOVES SUPPORT FOR VARIOUS CRYPTOCURRENCIES FOLLOWING SEC RULING

Robinhood, a brokerage firm, has decided to remove support for Cardano (ADA), Polygon (MATIC), and Solana (SOL) cryptocurrencies following the US Securities and Exchange Commission (SEC) labeling them as securities. The delisting will take effect on June 27, but investors can still buy, sell, and hold these tokens until that date. Robinhood clarified that this decision will not affect other cryptocurrencies held on their platform. Investors have the option to transfer ADA, MATIC, and SOL to another wallet or crypto firm, but any remaining tokens will be automatically sold and credited.

In recent developments, the SEC has filed lawsuits against Binance, the world’s largest crypto exchange, and Coinbase, the largest US-based crypto exchange, accusing them of various violations of securities laws. The SEC’s charges included classifying ADA, MATIC, and SOL, among others, as securities. Robinhood, whose legal chief is a former SEC commissioner, stated that it is reviewing the regulator’s analysis to determine if any actions are necessary. The SEC accused Binance and its CEO of operating illegally, defrauding investors, and engaging in suspicious money movements, while Coinbase was sued for unlawfully operating its exchange without registering with the SEC and conducting unregistered security offerings.

AS TRADITIONAL BANKS STEP BACK, NEW PLAYERS FILL GAP IN CRYPTO BANKING

Traditional banks are becoming more cautious about servicing the cryptocurrency industry, creating a gap that smaller regional banks and alternative payment service providers are stepping in to fill. In the US, Customers Bancorp has launched a real-time payment platform to support US dollar transfers for cryptocurrency transactions, while other banks such as Cross River Bank and Western Alliance Bancorp have also provided banking services to some cryptocurrency companies. This shift in the banking landscape follows the collapse of crypto-friendly banks like Silvergate Bank and Signature Bank, which prompted cryptocurrency firms to seek other banking alternatives. As a result, the banking landscape has become more fragmented and global, potentially creating a more resilient banking system.

In other jurisdictions, there are also crypto-friendly banks. Standard Chartered in Asia provides banking services to select digital asset service providers in Singapore, Hong Kong, and the UAE, while DBS Group offers deposit accounts to regulated digital asset and blockchain firms. In Europe, banks like Bank Frick & Co., SEBA Bank, and Sygnum Bank offer banking services to cryptocurrency companies. The change in banking access for cryptocurrency firms is a response to regulatory crackdowns in the industry, such as those by the US Securities and Exchange Commission. Despite the challenges, a new crypto banking system is emerging, and the use of multiple banking-service providers could make the system more robust, providing some advantages over the previous centralized approach.