Contents

What Is a Non-Fungible Token (NFT)?

Non-fungible tokens (NFTs) are assets that have been tokenized via a blockchain. They are assigned unique identification codes and metadata that distinguish them from other tokens. NFTs can be traded and exchanged for money, cryptocurrencies, or other NFTs—it all depends on the value the market and owners have placed on them. For instance, you could use an exchange to create a token for an image of a banana. Some people might pay millions for the NFT, while others might think it worthless. Cryptocurrencies are tokens as well; however, the key difference is that two cryptocurrencies from the same blockchain are interchangeable—they are fungible. Two NFTs from the same blockchain can look identical, but they are not interchangeable.

Key Takeaways

- NFTs (non-fungible tokens) are unique cryptographic tokens that exist on a blockchain and cannot be replicated.

- NFTs can represent digital or real-world items like artwork and real estate.

- “Tokenizing” these real-world tangible assets makes buying, selling, and trading them more efficient while reducing the probability of fraud.

- NFTs can represent individuals’ identities, property rights, and more.

- Collectors and investors initially sought NFTs after the public became more aware of them, but their popularity has since waned.

Blockchain and Fungibility

Like physical money, cryptocurrencies are usually fungible from a financial perspective, meaning that they can be traded or exchanged, one for another. For example, one bitcoin is always equal in value to another bitcoin on a given exchange, similar to how every dollar bill of U.S. currency has an implicit exchange value of $1. This fungibility characteristic makes cryptocurrencies suitable as a secure medium of transaction in the digital economy.For this reason, NFTs shift the crypto paradigm by making each token unique and irreplaceable, making it impossible for one non-fungible token to be “equal” to another. They are digital representations of assets and have been likened to digital passports because each token contains a unique, non-transferable identity to distinguish it from other tokens. They are also extensible, meaning you can combine one NFT with another to create a third, unique NFT.

Examples of NFTs

Perhaps the most famous use case for NFTs is that of cryptokitties. Launched in November 2017, cryptokitties are digital representations of cats with unique identifications on Ethereum’s blockchain. Each kitty is unique and has a different price. They “reproduce” among themselves and create new offspring with other attributes and valuations compared to their “parents.”Within a few short weeks of their launch, cryptokitties racked up a fan base that spent $20 million worth of ether to purchase, feed, and nurture them. Some enthusiasts even spent upward of $100,000 on the effort. More recently, the Bored Ape Yacht Club has garnered controversial attention for its high prices, celebrity following, and high-profile thefts of some of its 10,000 NFTs.Much of the earlier market for NFTs was centered around digital art and collectibles, but it has evolved into much more. For instance, the popular NFT marketplace OpenSea has several NFT categories:

- Photography: Photographers can tokenize their work and offer total or partial ownership. For example, OpenSea user erubes1 has an “Ocean Intersection” collection of beautiful ocean and surfing photos with several sales and owners.

- Sports: Collections of digital art based on celebrities and sports personalities.

- Trading cards: Tokenized digital trading cards. Some are collectibles, while others can be traded in video games.

- Utility: NFTs that can represent membership or unlock benefits.

- Virtual worlds: VIrtual world NFTs grant you ownership of anything from avatar wearables to digital property.

- Art: A generalized category of NFTs that includes everything from pixel to abstract art

- Collectibles: Bored Ape Yacht Club, Crypto Punks, and Pudgy Panda are some examples of NFTs in this category

- Domain names: NFTs that represent ownership of domain names for your website(s)

- Music: Artists can tokenize their music, granting buyers the rights the artist wants them to have

Benefits of Non-Fungible Tokens

Perhaps, the most apparent benefit of NFTs is market efficiency. Tokenizing a physical asset can streamline sales processes and remove intermediaries. NFTs representing digital or physical artwork on a blockchain can eliminate the need for agents and allow sellers to connect directly with their target audiences (assuming the artists know how to host their NFTs securely).

Investing

NFTs can also be used to streamline investing. For example, consulting firm Ernst & Young has already developed an NFT solution for one of its fine wine investors—by storing wine in a secure environment and using NFTs to protect provenance. Real estate can also be tokenized—a property could be parceled into multiple sections, each containing different characteristics. For example, one of the sections might be on a lakeside, while another is closer to the forest. Depending on its features, each piece of land could be unique, priced differently, and represented by an NFT. Real estate trading, a complex and bureaucratic affair, could then be simplified by incorporating relevant metadata into a unique NFT associated with only the corresponding portion of the property. NFTs can represent ownership in a business, much like stocks—in fact, stock ownership is already tracked via ledgers that contain information such as the stockholder’s name, date of issuance, certificate number, and the number of shares. A blockchain is a distributed and secured ledger, so issuing NFTs to represent shares serves the same purpose as issuing stocks. The main advantage to using NFTs and blockchain instead of a stock ledger is that smart contracts can automate ownership transferral—once an NFT share is sold, the blockchain can take care of everything else.

Security

Non-fungible tokens are also very useful in identity security. For example, personal information stored on an immutable blockchain cannot be accessed, stolen, or used by anyone that doesn’t have the keys. NFTs can also democratize investing by fractionalizing physical assets like real estate. It is much easier to divide a digital real estate asset among multiple owners than a physical one. That tokenization ethic need not be constrained to real estate; it can extend to other assets, such as artwork. Thus, a painting need not always have a single owner. Instead, multiple people can purchase a share of it, transferring ownership of a fraction of the physical painting to them. Such arrangements could increase its worth and revenues because more people can purchase parts of expensive art than those who can buy entire pieces.

How Can I Buy NFTs?

Many NFTs can only be purchased with ether (ETH), so owning some of this cryptocurrency—and storing it in a digital wallet—is usually the first step. You can purchase NFTs via any of the online NFT marketplaces, including OpenSea, Rarible, and SuperRare.

Are NFTs Safe?

Non-fungible tokens, which use blockchain technology like cryptocurrency, are generally impossible to hack. However, the weak link in all blockchains is the key to your NFT. The software that stores the keys can be hacked, and the devices you hold the keys on can be lost or destroyed—so the blockchain mantra “not your keys, not your coin” applies to NFTs as well as cryptocurrency. NFTs are safe as long as your keys are properly secured.

What Does Non-Fungible Mean?

Fungibility describes the interchangeability of goods. For example, say you had three notes with identical smiley faces drawn on them. When you tokenize one of them, that note becomes distinguishable from the others—it is non-fungible. The other two notes are indistinguishable, so they can each take the place of the other.

A blockchain is a distributed database or ledger shared among a computer network’s nodes. They are best known for their crucial role in cryptocurrency systems for maintaining a secure and decentralized record of transactions, but they are not limited to cryptocurrency uses. Blockchains can be used to make data in any industry immutable—the term used to describe the inability to be altered. Because there is no way to change a block, the only trust needed is at the point where a user or program enters data. This aspect reduces the need for trusted third parties, which are usually auditors or other humans that add costs and make mistakes. Since Bitcoin’s introduction in 2009, blockchain uses have exploded via the creation of various cryptocurrencies, decentralized finance (DeFi) applications, non-fungible tokens (NFTs), and smart contracts.

KEY TAKEAWAYS

- Blockchain is a type of shared database that differs from a typical database in the way it stores information; blockchains store data in blocks linked together via cryptography.

- Different types of information can be stored on a blockchain, but the most common use for transactions has been as a ledger.

- In Bitcoin’s case, blockchain is decentralized so that no single person or group has control—instead, all users collectively retain control.

- Decentralized blockchains are immutable, which means that the data entered is irreversible. For Bitcoin, transactions are permanently recorded and viewable to anyone.

The Bottom Line

Non-fungible tokens are an evolution of the relatively simple concept of cryptocurrencies. Modern finance systems consist of sophisticated trading and loan systems for different asset types, from real estate to lending contracts to artwork. By enabling digital representations of assets, NFTs are a step forward in the reinvention of this infrastructure.

What Is an NFT?

An NFT is a digital asset that can come in the form of art, music, in-game items, videos, and more. They are bought and sold online, frequently with cryptocurrency, and they are generally encoded with the same underlying software as many cryptos.

Although they’ve been around since 2014, NFTs are gaining notoriety now because they are becoming an increasingly popular way to buy and sell digital artwork. The market for NFTs was worth a staggering $41 billion in 2021 alone, an amount that is approaching the total value of the entire global fine art market.

NFTs are also generally one of a kind, or at least one of a very limited run, and have unique identifying codes. “Essentially, NFTs create digital scarcity,” says Arry Yu, chair of the Washington Technology Industry Association Cascadia Blockchain Council and managing director of Yellow Umbrella Ventures.

This stands in stark contrast to most digital creations, which are almost always infinite in supply. Hypothetically, cutting off the supply should raise the value of a given asset, assuming it’s in demand.

But many NFTs, at least in these early days, have been digital creations that already exist in some form elsewhere, like iconic video clips from NBA games or securitized versions of digital art that’s already floating around on Instagram.

Famous digital artist Mike Winklemann, better known as “Beeple,” crafted a composite of 5,000 daily drawings to create perhaps the most famous NFT of 2021, “EVERYDAYS: The First 5000 Days,” which sold at Christie’s for a record-breaking $69.3 million.

Anyone can view the individual images—or even the entire collage of images online for free. So why are people willing to spend millions on something they could easily screenshot or download?

Because an NFT allows the buyer to own the original item. Not only that, it contains built-in authentication, which serves as proof of ownership. Collectors value those “digital bragging rights” almost more than the item itself.

How Is an NFT Different from Cryptocurrency?

NFT stands for non-fungible token. It’s generally built using the same kind of programming as cryptocurrency, like Bitcoin or Ethereum, but that’s where the similarity ends.

Physical money and cryptocurrencies are “fungible,” meaning they can be traded or exchanged for one another. They’re also equal in value—one dollar is always worth another dollar; one Bitcoin is always equal to another Bitcoin. Crypto’s fungibility makes it a trusted means of conducting transactions on the blockchain.

NFTs are different. Each has a digital signature that makes it impossible for NFTs to be exchanged for or equal to one another (hence, non-fungible). One NBA Top Shot clip, for example, is not equal to EVERYDAYS simply because they’re both NFTs. (One NBA Top Shot clip isn’t even necessarily equal to another NBA Top Shot clip, for that matter.)

How Does an NFT Work?

NFTs exist on a blockchain, which is a distributed public ledger that records transactions. You’re probably most familiar with blockchain as the underlying process that makes cryptocurrencies possible.

Specifically, NFTs are typically held on the Ethereum blockchain, although other blockchains support them as well.

An NFT is created, or “minted” from digital objects that represent both tangible and intangible items, including:

- Graphic art

- GIFs

- Videos and sports highlights

- Collectibles

- Virtual avatars and video game skins

- Designer sneakers

- Music

Even tweets count. Twitter co-founder Jack Dorsey sold his first ever tweet as an NFT for more than $2.9 million.

Essentially, NFTs are like physical collector’s items, only digital. So instead of getting an actual oil painting to hang on the wall, the buyer gets a digital file instead.

They also get exclusive ownership rights. NFTs can have only one owner at a time, and their use of blockchain technology makes it easy to verify ownership and transfer tokens between owners. The creator can also store specific information in an NFT’s metadata. For instance, artists can sign their artwork by including their signature in the file.

What Are NFTs Used For?

Blockchain technology and NFTs afford artists and content creators a unique opportunity to monetize their wares. For example, artists no longer have to rely on galleries or auction houses to sell their art. Instead, the artist can sell it directly to the consumer as an NFT, which also lets them keep more of the profits. In addition, artists can program in royalties so they’ll receive a percentage of sales whenever their art is sold to a new owner. This is an attractive feature as artists generally do not receive future proceeds after their art is first sold.

Art isn’t the only way to make money with NFTs. Brands like Charmin and Taco Bell have auctioned off themed NFT art to raise funds for charity. Charmin dubbed its offering “NFTP” (non-fungible toilet paper), and Taco Bell’s NFT art sold out in minutes, with the highest bids coming in at 1.5 wrapped ether (WETH)—equal to $3,723.83 at time of writing.

Nyan Cat, a 2011-era GIF of a cat with a pop-tart body, sold for nearly $600,000 in February. And NBA Top Shot generated more than $500 million in sales as of late March. A single LeBron James highlight NFT fetched more than $200,000.

Even celebrities like Snoop Dogg and Lindsay Lohan are jumping on the NFT bandwagon, releasing unique memories, artwork and moments as securitized NFTs.

How to Buy NFTs

If you’re keen to start your own NFT collection, you’ll need to acquire some key items:

First, you’ll need to get a digital wallet that allows you to store NFTs and cryptocurrencies. You’ll likely need to purchase some cryptocurrency, like Ether, depending on what currencies your NFT provider accepts. You can buy crypto using a credit card on platforms like Coinbase, Kraken, eToro and even PayPal and Robinhood now. You’ll then be able to move it from the exchange to your wallet of choice.

You’ll want to keep fees in mind as you research options. Most exchanges charge at least a percentage of your transaction when you buy crypto.

An NFT’s value is based entirely on what someone else is willing to pay for it. Therefore, demand will drive the price rather than fundamental, technical or economic indicators, which typically influence stock prices and at least generally form the basis for investor demand.

All this means, an NFT may resale for less than you paid for it. Or you may not be able to resell it at all if no one wants it.

NFTs are also subject to capital gains taxes—just like when you sell stocks at a profit. Since they’re considered collectibles, however, they may not receive the preferential long-term capital gains rates stocks do and may even be taxed at a higher collectibles tax rate, though the IRS has not yet ruled what NFTs are considered for tax purposes. Bear in mind, the cryptocurrencies used to purchase the NFT may also be taxed if they’ve increased in value since you bought them, meaning you may want to check in with a tax professional when considering adding NFTs to your portfolio.

What makes a token non-fungible?

Earlier we mentioned serial numbers as a way to distinguish one dollar bill from another. Even though you can tell them apart, two dollar bills are still fungible because they each have the same value as currency. A unique identifier alone is not enough to make something non-fungible.

However, a dollar bill that’s been sketched on by Picasso is unique in a way that has nothing to do with serial numbers. By using it as a medium for artwork, our imaginary Picasso has made the bill less fungible. While you could technically redeem it for a dollar’s worth of snacks, the exchange value of the bill is now far greater than one dollar.

In the same way, by allowing each token to contain a small amount of arbitrary data, NFTs become a medium for creative expression, as well as a unit of exchange and account. The value of an NFT is thus highly dependent on the data it contains and represents. The same NFT may be valued completely differently by different people, based on factors like aesthetic taste or the identity of the creator.

Of course, there’s a good reason we don’t conduct business by swapping priceless Picasso sketches around! Without fungibility, an NFT isn’t much good as currency. However, by existing on the same networks that enable digital currency, NFTs can leverage the payment and account infrastructure for transactions and benefit from the security guarantees of the blockchain.

How are NFTs special?

What makes an NFT different from an animated GIF file on someone’s website, or from other kinds of digital records like a spreadsheet?

The differences hinge on a few core properties of the blockchain design. The primary function of a blockchain network is to get all the participants to agree on a single shared “state of the world”. For Bitcoin, the shared state is the balance of every account, while for Ethereum, that shared state is the inputs and outputs of smart-contract interactions. Because the members of the network are spread out across the world, it takes time for everyone to converge on the same state, and there are special rules to prevent cheating or malicious behavior. Once everyone has agreed on the state, it becomes part of the canonical history of the blockchain.

As new blocks are added to the chain, earlier blocks become harder and more expensive to modify. Soon — generally within a few blocks — the cost to “change history” becomes so great that it is effectively impossible, and the information recorded in the blockchain can be considered permanent.

By contrast, the traditional web is famously impermanent and dynamic. A web server may serve different content based on, for example, the time of day or the geolocation of the visitor’s IP address. And as anyone who’s been frustrated by an outdated link can testify, content disappears from the web nearly as often as it arrives.

This property of permanence and stability is central to the NFT value proposition. By using a blockchain as a durable shared data storage medium, NFTs can be trusted to endure as long as the blockchain itself remains operational — which brings up another interesting property of blockchains. By rewarding node operators with cryptocurrency in exchange for keeping the network alive, a blockchain incentivizes its own survival. As long as there are people attracted to the economic reward, there will be someone motivated to keep the network online. This ensures the survival of all historical data, including NFTs.

We are still in the early days of NFTs, and it’s very likely that we’ll see a new crop of interesting NFT use cases and experiences that are outside of anything being done today. It’s hard to predict what the future will bring.

Each NFT has a unique identification code that can’t be replicated or copied and metadata that can be linked to a variety of things to provide immutable proof of ownership. For example, the metadata an NFT contains can be tied to digital images, songs, videos, or avatars. It can also be linked to physical items, like cars and yachts, or used to give an NFT owner access to exclusive merchandise, tickets to live or digital events, or other exclusive perks.

When it comes to creating and selling NFTs, the process is really rather simple. It works like this:

- An individual (or company) selects a unique asset to link to an NFT.

- They add the object to a blockchain that supports NFTs through a process called “minting,” which creates the NFT.

- The NFT now represents that item on the blockchain, verifying proof of ownership in an immutable record.

- The NFT can be kept as part of a private collection, or it can be bought, sold, and traded using NFT marketplaces and auctions.

As you might imagine, the technical definition is a bit more convoluted. If you’re interested in that kind of breakdown, our NFT dictionary gives you a comprehensive overview of all the technology and infrastructure in the NFT ecosystem.

You use the money in your bank account to purchase goods and services in the real world. Similarly, cryptocurrency is what you use for any and all transactions on the blockchain. Crypto can be purchased or converted into fiat currencies (dollars, euros, yen, etc.) or other cryptocurrencies (BTC, ETH, SOL, etc.) via crypto exchanges. By contrast, an NFT is a unique and irreplaceable asset that can be purchased using cryptocurrency. It can gain or lose value independent of the currency used to buy it, just like a popular trading card or a unique piece of art.

In short: NFTs are non-fungible, and cryptocurrencies are fungible.

Why own NFTs?

The demand for NFT art has exploded recently. However, there is still a lot of skepticism. After all, NFTs are generally tied to digital files. How is owning such an NFT different from a screenshot of a photo? Does “proof of ownership” mean anything? To help you decide, here are some of the main reasons why people own NFTs.

1) It empowers artists

Publishers, producers, and auction houses often strong-arm creators into contracts that don’t serve their interests. With NFTs, artists can mint and sell their work independently, allowing them to retain the IP and creative control. Artists can also earn royalties from all secondary sales of their work.

In this respect, NFTs have the potential to create fairer models by bypassing the gatekeepers that currently control creative industries, and many individuals buy NFTs because it’s a way of empowering and financially supporting the creators that they love.

2) Collectibility

Despite costing less than 5 cents to make, a 1952 Mickey Mantle rookie card sold for $5.2 million. This happened because of the history, rarity, and cultural relevance of the card. NFTs are, in many ways, the digital version of this. For individuals who want to build a collection of digital assets, NFTs offer a unique opportunity that hasn’t existed outside of traditional collectibles and art markets ever before.

3) Investment

Some NFT owners simply want an asset that will increase in value. In this respect, some collectors treat NFTs as an investment — much like traditional art. Want proof? Mike Winkelmann, a prominent American digital artist known professionally as Beeple, sold his Everydays: The First 5000 Days composite at Christie’s for $69 million in March of 2021.

This may seem strange to some, as everyone can see and interact with the image. However, as noted, there can only be one NFT owner. For some, this is enough. Yet, market volatility makes NFT investment a high risk, with the potential for major losses.

4) Community

NFT Ownership also comes with social benefits, as many creators have turned their NFT projects into vibrant communities. The Bored Ape Yacht Club is, perhaps, the best example of community building in relation to an NFT project. Collectors get access to a members-only discord, exclusive merchandise, a vote in the future of the project, tickets to virtual meetups, and more. As such, for many collectors, owning an NFT how they socialize with friends and a matter of identity.

The environmental impact of NFTs

Of course, the NFT boom isn’t without its downsides. Among the most frequent criticisms relates to the energy needs for operating blockchains that use proof-of-work consensus systems to validate transactions. Before the Ethereum merge to proof-of-stake consensus, a validation mechanism with energy needs that are orders of magnitude lower, Ethereum’s energy consumption rivaled that of entire countries when paired with the Bitcoin blockchain.

However, since the merge, Ethereum’s energy needs have fallen by a staggering 99.5 percent. In the past, many argued that NFTs contributed to blockchain’s overall carbon footprint because they promoted the use of the technology.

Unfortunately, many of the arguments critics used to denigrate proof-of-work blockchain were largely based on misinformation. Many appeared in articles that claimed to calculate the amount of energy needed to conduct a single NFT transaction, but these claims omitted the fact that proof-of-work consensus mechanisms mine blocks, not transactions, and many transactions can fit inside a single block. It’s also not easy to calculate how much energy a single NFT transaction uses.

Even if this weren’t the case, it’s important to keep perspective in mind when commenting on a technology’s energy needs. Numerous other technologies have obscene energy requirements. In fact, YouTube and Ethereum used to have roughly the same carbon footprint. That’s not an excuse regarding blockchains and the carbon footprint they leave behind, but it’s crucial to understand the issue in its proper context. No technology’s existence is as environmentally friendly as its absence, and deciding which technologies we deem valuable enough to continue to use is an ongoing conversation.

What’s more, some blockchains are already moving to solve the blockchain energy problem. For example, Solana uses a unique combination of proof-of-history (PoH), and several chains use a version of proof-of-stake mechanisms to substantially manage their energy use. The Liquid Proof-of-Stake (LPoS) mechanism employed by Tezos, for example, uses roughly two million times less energy than Ethereum did pre-merge.

There are plenty of valid criticisms to consider regarding blockchain technology, but perhaps a better question to ask is whether or not publications covering the NFT space will do a better job of analyzing the facts before maligning it.

NFTs have a nuanced relationship with the assets tied to them. While an NFT is designed to represent the original asset on the blockchain, the NFT itself is seen as a separate entity from any content it contains.

Say you own a vintage baseball card or a popular trading card from a collectible card game, like Magic: The Gathering. You own a representation of the original work — but you don’t own the original work itself. The copyright for the artwork, design, and branding of the card you possess are wholly owned by the card’s manufacturer.

In the same way, while NFTs represent an item on the blockchain, ownership of an NFT does not transfer the intellectual property or usage rights of that original work to you.

For example, let’s say you buy an NFT that contains the very first digital copy of Harry Potter and Sorcerer’s Stone. You own the NFT. But that doesn’t mean you have the right to sell Harry Potter merchandise, make Harry Potter movies, or give others permission to use the Harry Potter IP for commercial purposes.

Sadly, NFT ownership and usage rights are often conflated, which has given rise to some buyers purchasing NFTs with the mistaken understanding that an NFT effectively gives them the rights to expand upon (and capitalized from) well-established IPs.

Of course, there are some exceptions to these hard and fast rules. Bored Ape Yacht Club has stated publicly that all BAYC NFT owners have full commercial rights to that Ape. It can be monetized however the NFT owner sees fit to do so. Some projects like CrypToadz and Nouns have taken this even further by releasing their IP to the public domain under Creative Commons (known as CC0). But they should be viewed as the exception, not the rule.

Copyrighted content

Using self-minting platforms like OpenSea, it’s possible for any user to mint a new NFT using copyrighted content that they don’t own. This is dangerous for the minter, buyers, and the original artist for a few reasons:

- By profiting off of illegitimate content, sellers and buyers open themselves up to legal action by the legitimate copyright holders.

- Legitimate NFTs issued by the copyright holder may be devalued by illegitimate NFTs of the same work.

- Buyers may not know that the content they’ve purchased is illegitimate or that they’ve put themselves in legal jeopardy with an illegitimate trade.

Concerns around legitimacy are one of the reasons that verified NFT projects and accounts are preferable. To stay safe on NFT marketplaces, always look for verified projects on platforms, and only follow links from official (and verified) user accounts on social media.

In the case of sales that take place via official websites, like with Art Blocks or NBA Top Shot, buyers can act with confidence knowing that their NFT comes from a legitimate source.

NFT scams explained

Rug pulls

Even though large generative projects are preferred by collectors, there’s not always safety in numbers, and no NFT project is entirely without risk. In fact, many projects have fallen apart due to rug pull scams. A rug pull occurs when the project creators take the investment money for the project and disappear. By absconding with all of the money, the team leaves collectors with a valueless asset.

Notably, these kinds of rug pulls often aren’t illegal. Are they unethical? Sure. But if a project promises to donate funds and then chooses to keep the money, there isn’t much that anyone can do. In rare instances, a rug pull may count as fraud, but this often isn’t the case.

Rug pulls can also happen when NFT developers remove the ability for investors to sell their tokens. These kinds of rug pulls are illegal, and you may be able to recoup your money. However, it will probably cost you a lengthy court battle. Additionally, many NFT creators don’t use their legal names, so it may be difficult (or even impossible) to track them down.

Wash trading

As with stocks and other collectibles, market manipulation can happen during NFT auctions.

Working together, a group of potential buyers can drive up the price of an NFT by artificially inflating the bid price until an unsuspecting buyer joins the fray. After the sale, the asset deflates in value, leaving the buyer with a valueless NFT. One of the most common ways of doing this with NFTs is with wash trading. Wash trading occurs when a user controls both sides of an NFT trade, selling the NFT from one wallet and purchasing it from another.

When many transactions like this are executed, the trade volume rises. As a result, it looks like the underlying asset is highly sought after. This has the effect of increasing the value (the price) of the NFT in question. In fact, some NFT wash traders have executed hundreds of transactions through self-controlled wallets to try and increase demand.

Phishing scams

Whether through fake advertisements, NFT giveaways, or some other form of coercion, scammers will sometimes ask for your private wallet keys and/or other sensitive information like your seed phrase.

Depending on what information they get access to, the scammer can then access your wallet and remove any cryptocurrency or NFTs stored within or sign transactions without your consent. Because blockchain is decentralized and often anonymous (i.e. there’s no regulatory authority and individuals don’t have submit proof of identity to use it) there’s generally no way to recover your assets if this happens.

Just like password phishing emails, these scams come in all stripes, and they can be very hard to spot if you aren’t looking for them. As a reminder: Never share your seed phrase or private keys with anyone or they will be able to access your funds, and only follow links from official websites and accounts.

Taxes and NFTs

Taxes, as they pertain to NFTs and crypto, can be complicated. Especially since tax responsibilities vary by country. But throughout every context, a crucial facet of NFTs and taxes is that acquiring a large sum of money by trading NFTs will almost always be considered a capital gain, and be taxed as such. So make sure to keep a record of profits and losses, at the very least.

On the other hand, NFT creators — those who have minted and sold their own NFTs — will need to separate trading income from that of the sales of their own pieces. The general rule of thumb to follow as an NFT artist/creator is: when you sell an NFT, you will have to pay taxes on the profits. Profits for NFT creators are not considered gains, rather, they’re income. And this income will be taxed at your regular (usually self-employed) income tax rate.

Again, tax specifics will vary based on the legalities within your region, but NFTs are not a tax-free investment, and that is for sure. Be careful if you plan to treat them as such.

But what about crypto philanthropy? We’ve seen a sharp rise in “intentional charitable donations” made via NFTs in recent years. The geopolitical crisis in Ukraine stands as a perfect example of how NFTs can be used to positively impact communities in need.

In fact, more than 1,300 nonprofits accepted crypto-based donations in the past few years, which are considered tax-deductible in the U.S., among other countries. Meaning that taxpayers can get a tax-deductible write-off for donations they made in crypto or NFTs. But again, this will vary from country to country.

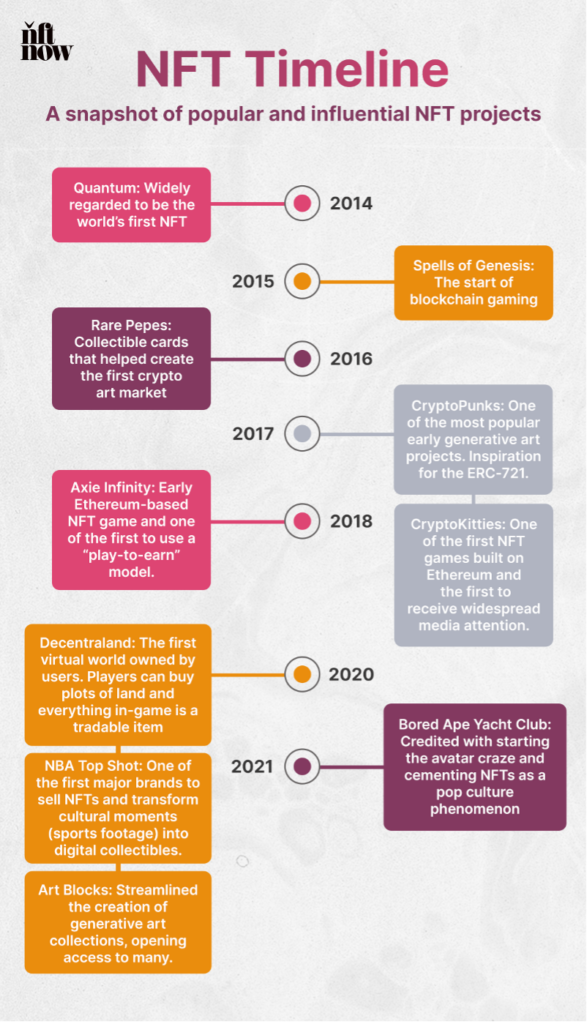

Most people first heard of NFTs in 2021. However, the tokens actually got their start nearly a decade earlier. “Quantum” was the first NFT ever created. It was minted by Kevin McCoy on Namecoin in 2014. Over the next two years, several other NFTs were launched on pre-Ethereum blockchains. However, these projects failed to reach widespread popularity and remained mostly unknown.

NFTs only started to gain mainstream momentum in 2017, when the first NFT collections were launched on the Ethereum blockchain. Although it wasn’t the first NFT project on Ethereum, CryptoPunks stands as of the most popular of these early collections and helped truly kickoff the crypto art movement.

The next four years were filled with a bevy of niche project launches across a wide range of blockchains. Then 2021 rolled around, and things really took off.

Two catalysts helped start the 2021 bull run. The first was the COVID-19 pandemic. It caused individuals worldwide to become more digitally native, and platforms like Twitter and Clubhouse quickly became Web2 bastions for Web3’s most excited builders. The second is Beeple, who became the first creator to sell an NFT with a major auction house. Christie’s auction for Beeple’s “Everydays — The First 5000 Days” closed for $69 million, and NFTs could no longer be ignored.

As mainstream adoption increased, so did the sales volumes and price points. This led to an explosion of interest from companies and brands looking to launch their own NFT projects. Early adopters include brands like Coca-Cola, Taco Bell, Hot Wheels, and Adidas.

What’s next? It’s honestly hard to say. Given how young NFTs are at the moment, where NFTs stand now is likely to look vastly different within a short period of time.

Are NFTs just paying for a jpeg? Can’t I just save a copy?

Not exactly. The most important feature of NFTs is that they are unique – and the uniqueness is recognized by everyone else on the blockchain.

And while some of the most famous NFT projects are related to generative profile pictures (or PFPs) that are popular to trade among enthusiasts, an NFT can really be anything, says Hess. “There’s a wide variety of use cases that NFTs are now finding for themselves.”

For example, an NFT can be a profile picture, like from the popular Degenerate Ape Academy project. It can also be an item in a video game, like the starships in Star Atlas. It can be a short looping animation, a video, a photo… most any sort of digital asset! It could even represent a loan, or proof you bought a ticket to a concert!

What can you do with an NFT?

Once you can prove something is unique, you can prove something can be linked to a specific wallet. This type of uniqueness and ownership is a huge deal in the digital world. The idea of ownership on the internet has been very fuzzy — meme accounts stealing jokes, bots stealing art to make tee shirts and profit, and countless other stories of people whose online works have been reproduced.

And once you establish unique digital ownership, you can build some very interesting functionality.

- Several NFT projects have started DAOs, or decentralized communities, that share a treasury and work towards goals. The DeGods NFT project purchased a basketball team; several other NFT projects launched their own validator nodes to secure the greater Solana network.

- Hess suggests that NFTs could serve as a form of digital identity going forward, replacing current login systems that require accounts on web2 companies like Facebook and Google. “I think that when you login in the future,” he says, “you likely will log in with an NFT.”

- Atlas Cafe in San Francisco teamed up with Solana Pay to launch a special, limited-edition NFT that gave users a discount on products in the store.

- Lollapalooza created an NFT series that, when collected, allows attendees to unlock VIP ticket upgrades or merchandise.

- “As for media and music,” Hess also says, “I think we will see both tokenized access for content and content itself being sold as discrete units through NFTs.”

And that’s just the tip of the iceberg.

“I think when you look closer,” said Hess, “what you see are the beginnings of web3 communities and decentralized social networking.”

How do I make my own NFT?

If you’re an artist who wants to create an NFT, minting an NFT can be very easy. At the most basic level, all you need is…

- A wallet.

- The art file (or files).

- A description.

- A small amount of cryptocurrency to pay processing fees (on Solana, these fees are a few cents or even a fraction of a cent).

“I would encourage anyone that’s interested in building in the Solana ecosystem, or building an NFT project, to take a look at Metaplex and the tools that we provide,” Hess says. Metaplex provides a number of tools to help artists create their projects — which can range from simply minting your NFT to creating your own customized storefront for your community.